# of Payments Per Term

Overview

The # of Payments per Term defines exactly how many individual commission payments are expected between the Term Effective Date and the Term Renewal Date.

While the "Term Length" tells the system how long the policy lasts, this field tells the system how often the money arrives (e.g., Monthly, Quarterly, or Annually).

📅 Common Payment Frequencies

Most insurance policies operate on a 12-month term, but the number of payments can vary based on the carrier's billing cycle:

| Billing Cycle | # of Payments per Term | Example |

|---|---|---|

| Monthly | 12 | The most common setup for Health and Life. |

| Quarterly | 4 | Payments arrive every 3 months. |

| Semi-Annual | 2 | Payments arrive twice a year. |

| Annual | 1 | One single payment for the entire term. |

🧮 How the Math Works

The system uses this number to divide your total expected commission across the term.

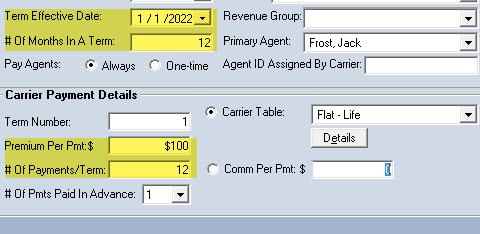

Example: Standard Monthly Policy

- Term Effective Date: 1/1/2022

- Term Length: 12 Months

- Premium Per Payment: $100

- # of Payments Per Term: 12

The Result: Commission Tracker will create 12 individual billing slots (January through December), each expecting a payment based on the $100 premium.

⚠️ Important Considerations

- Term Length vs. Payments: Do not confuse the "Term Length" (in months) with "Payments per Term." For example, a 12-month policy paid Quarterly would have a term length of 12, but only 4 payments per term.

- Revenue Accrual: If you set this to

1for an annual policy, the system expects the entire year's commission in a single month. If you set it to12, the system will look for a smaller amount every month. - Prorated Terms: If you are entering a policy mid-term, you should still enter the standard number of payments for a full term; the system will simply show the earlier months as "Open" or "Missing."

💡 Tips for Success

- ✅ Match the Carrier: Ensure this number matches how the carrier actually pays you. If they pay monthly but you set this to 1, your Accounts Receivable will look incorrect for 11 months of the year.

- ✅ Standardize via Carrier Tables: You can set the default # of Payments per Term on your Carrier Commission Tables so you don't have to type it manually for every new policy.

Still Need Help?

Are you dealing with upfront payments? Learn how this interacts with the Number of Payments Paid In Advance.