Premium Per Payment

Overview

Premium Per Payment is the estimated dollar amount expected for each payment cycle. Commission Tracker stores both this estimate and the actual premium received for every payment.

✅ Recommended Method

Premium Per Payment is the standard and recommended way to define policy premiums. It ensures clear monthly expectations in your tracking.

⚠️ Premium Per Term (Not Recommended)

This option tracks the total value of the entire term rather than individual payments.

-

Formula: $(Monthly\ Premium) \times (Months\ in\ Term) = Total\ Term\ Premium$

-

Example: $100/mo for 12 months = $1,200 total.

-

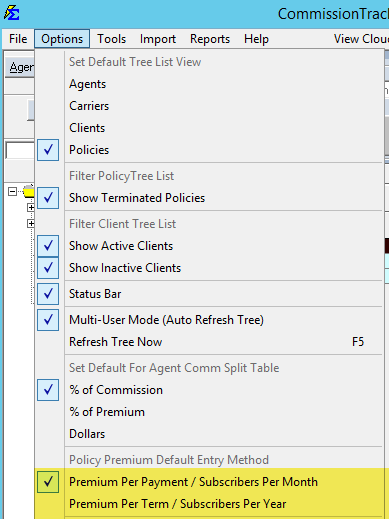

Configuration: This can be changed in the Options menu.

💡 Best Practices

- ✅ Estimate Accuracy: Use the most likely monthly premium to keep your Accounts Receivable forecasts accurate.

- ✅ Reconciliation: The system will automatically log the "Actual Premium" when you post carrier payments, so your estimates don't need to be perfect.